Archer Aviation Inc. is years from producing its only planned product, a four-passenger electric air taxi that the main U.S. regulator hasn’t yet certified. It hasn’t generated any revenue.

Still, the co-founders of this three-year-old company got a huge payday last month, a $99 million special stock award that stands to quadruple if Archer hits other milestones—thanks to a compensation package they negotiated before it listed publicly on Sept. 17.

For years, Silicon Valley was known as a place where leaders often bucked American corporate customs when it came to pay. Rather than receiving large stock grants and salaries, company founders like Facebook Inc.’s Mark Zuckerberg and Amazon. com Inc.’s Jeff Bezos took little or nothing. Instead, they benefited from the rising value of stock they got by starting their companies.

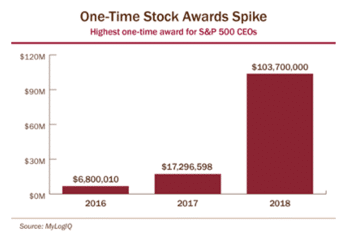

…Seven of the 10 most valuable compensation packages for U.S. public companies in 2020 were to CEOs of startups that listed publicly that year, according to public-company data-and-analysis firm MyLogIQ LLC. Five of those startups paid their CEOs more than any company in the S&P 500, an index that includes the largest corporations in the country.